Taxpayers can purchase tax credits to offset their state income tax liability. Buying tax credits can provide up to a 10% savings on state income taxes.

TAX CREDITS FORMALLY APPROVED.

Tax credits are formally approved by the state through the Division of Conservation. Buyers can purchase tax credits up until the extended tax filing deadline. Beginning in 2021, the Division of Conservation tracks transfers of conservation easement tax credits. Upon verification and approval, the Division issues a new certificate to credit buyers. These changes provide for an expedited and streamlined program and peace of mind for tax credit buyers.

REGISTRATION

To purchase a tax credit call (303) 988-1700 or register with CTCT by completing and submitting our Buyer Registration Form.

Registration forms can be submitted securely through our website.

WHO CAN PURCHASE TAX CREDITS?

Colorado resident taxpayers, individuals, trusts, and C corporations, can purchase conservation tax credits. There is no limit on the amount that can be purchased. A buyer cannot have donated a conservation easement and purchased tax credits in the same tax year.

TRANSFER PROCESS

CTCT conducts a thorough due diligence review of all seller donation documents to ensure that we provide quality tax credits for our buyers. Once the Division of Conservation has issued a tax credit certificate to a seller and CTCT has accepted the credit for transfer, we match you with a credit seller. Both sellers and buyers execute CTCT’s Agreement to Purchase/Sell and a written transfer notice. Transfers are completed by delivering signed copies of the Agreement and checks from the buyers to the sellers and filing the written transfer notice with the Division of Conservation.

TAX FILING PAPERWORK

After the credits are sold, we provide the required paperwork documenting the completed transaction for both sellers and buyers to file with your Colorado state income tax return.

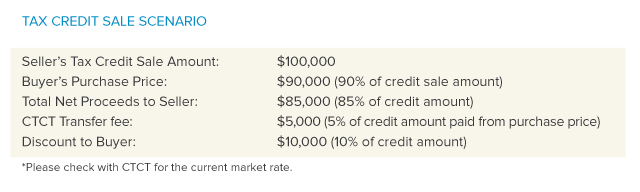

GOING MARKET RATE

The supply of tax credits affects the credit transfer rate. Credit buyers will receive a discount on the face value of the credit purchased based on the going market rate. Currently, the discount is approximately ten percent (10%). This rate can change over the course of the transfer year based on supply and demand. We transfer credits throughout the transfer year. Please check with us about the current discount rate.

Credit buyers can apply the full face value of the credit (not the purchase price) toward their Colorado state income tax liability and claim that amount as a Colorado state income tax deduction on their federal tax return.